Our final two chart images show the same spinning top forex patterns that appeared during a bullish trend. The bullish spinning top candlestick happens once the closing price exceeds the opening price. On the other hand, the bearish spinning top candlestick pattern happens once the opening price is much higher than the closing price.

- In other words, the market has explored upward and downward options but then settles at more or less the same opening price – resulting in no meaningful change.

- A target was again placed at a level that offered double the reward versus the risk taken on this trade setup.

- It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

- Both patterns are part of much larger patterns, like star formations.

- A spinning top candlestick means that a market has reached a point of indecision.

After all, neither buyers nor sellers currently have the upper hand. The bullish spinning top is a frequently occurring one-bar candlestick pattern that supposedly represents indecision. We research technical analysis patterns so you know exactly what works well for your favorite markets. An engulfing pattern is a 2-bar reversal candlestick patternThe first candle is contained with the 2nd candleA bullish… An evening star pattern is a bearish 3-bar reversal candlestick patternIt starts with a tall green candle, then a… The next candle should be the opposite of the current trend in the market.

This is what you learned today

This pattern happens when the asset forms long upper and lower shadows and a relatively small body. A stop-loss order was placed a few pips below the spinning top’s low, and a target was positioned at a level that offered double the reward versus the risk taken during this setup. With the RSI crossing above the lower horizontal line and the confirmation candle https://forexhero.info/outsource-c-development-to-narrasoft/ breaking above the spinning top’s high, a buy order was placed a few pips above the confirmation candle’s high. Spinning tops, even though they’re similar, have larger bodies where the close and the open are very near each other. The biggest difference in the middle of these patterns is that a spinning top, without exception, has longer legs on all sides.

It means that neither buyers nor sellers could gain the upper hand. Spinning Top Candlestick refers to a specific candlestick pattern representing indecision about the assets’ direction in the days to come. In other words, it represents a situation in which both sellers and buyers are able to gain the upper hand. This formation signals indecision with the following trend direction. There are a few ways to trade when you see the spinning top candlestick pattern.

How to Handle Risk with Spinning Top Pattern?

If so is the case, it is important to search for a candle in the same direction. It will confirm that the price action will continue in the same direction. However, as sellers start to enter the market, the stock price hits a new low, dropping down to Rs.235. Looking at the fall in stock prices, buyers step in and purchase Company ABC’s stocks in large numbers. This appearance occurs due to pulls and pressures faced by stock from both sellers and buyers. Due to these factors, we get to see a relatively short candlestick with elongated shadows on both sides.

Spinning Top Candlestick Definition – Investopedia

Spinning Top Candlestick Definition.

Posted: Sat, 25 Mar 2017 20:02:45 GMT [source]

Unlike the Marubuzo, it does not give the trader a trading signal with specific entry or an exit point. However, the spinning top gives out useful information concerning the current situation in the market. The trader can use this information to position himself in the market. We relied on the RSI indicator and a confirmation candlestick as our additional methods, which in turn allowed us to identify the spinning top forex patterns that generally lead to strong reversals. Keep in mind that with this type of forex spinning candlestick pattern, you can practice trading with a proper demo account where you can open and close positions risk-free. Due to these indicators, they’re able to have more information and insight into the price trends.

What Is Crypto Consolidation?

Traders could go long (buy) in the case of the upcoming reversal confirmation. You can utilize derivatives like CFDs or spread bets if they want to trade when they spot the spinning top candlestick pattern. Both Doji and spinning top candlestick patterns happen frequently. In some cases, they’re both used to alert the reversal after a solid price move.

Which candle is the most bullish?

A black or filled candlestick means the closing price for the period was less than the opening price; hence, it is bearish and indicates selling pressure. Meanwhile, a white or hollow candlestick means that the closing price was greater than the opening price. This is bullish and shows buying pressure.

Some traders use the boundary of the wicks to place their stop – at the top of the upper wick for a short trade, and the bottom of the lower wick for a long one. But depending on the formation of the pattern this can be too restrictive or mean taking on too much risk. On the other hand, if you spot a spinning top on a rangebound market it can signal a continuation of the consolidation.

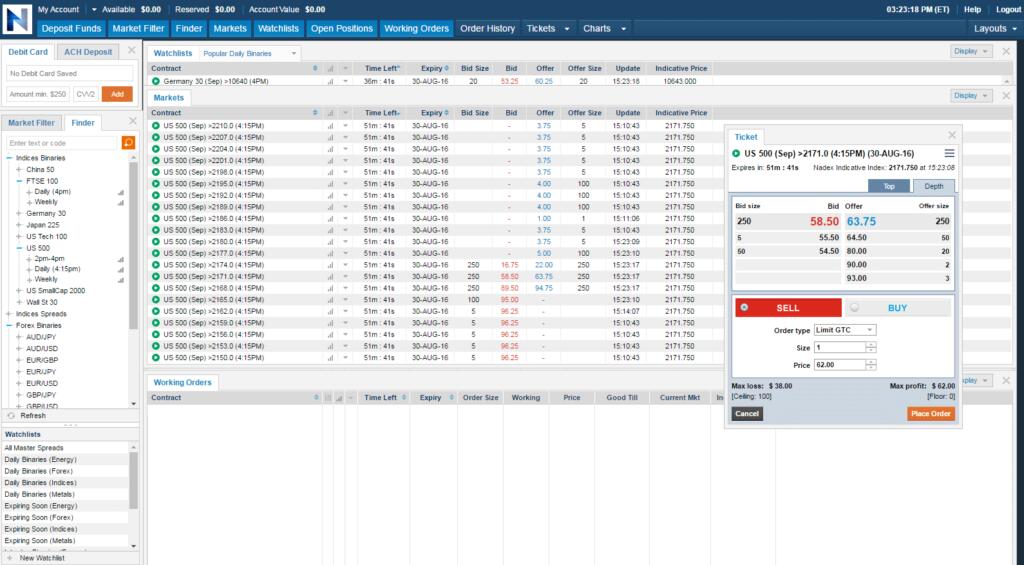

How to use Level 2 Data to Trade at a Higher Tier!

The breakout happens once the price closes below or above the top bottom of the candlestick. The bullish spinning top pattern occurs at the bottom of a downward trend and may signal a bullish trend reversal. Usually, when the pattern is formed, the chances of a trend reversal are very high as the asset enters a price consolidation mode. The spinning top candlestick pattern, or spinning bottom pattern, occurs when buyers and sellers find price equilibrium in a certain period of time, which indicates indecision in the market.

What is the most powerful candlestick pattern?

- Doji. Considered to be one of the most important single candlestick patterns, the doji can give you an insight into the market sentiment.

- Dragonfly doji.

- Gravestone doji.

- Spinning top.

- Hammer.